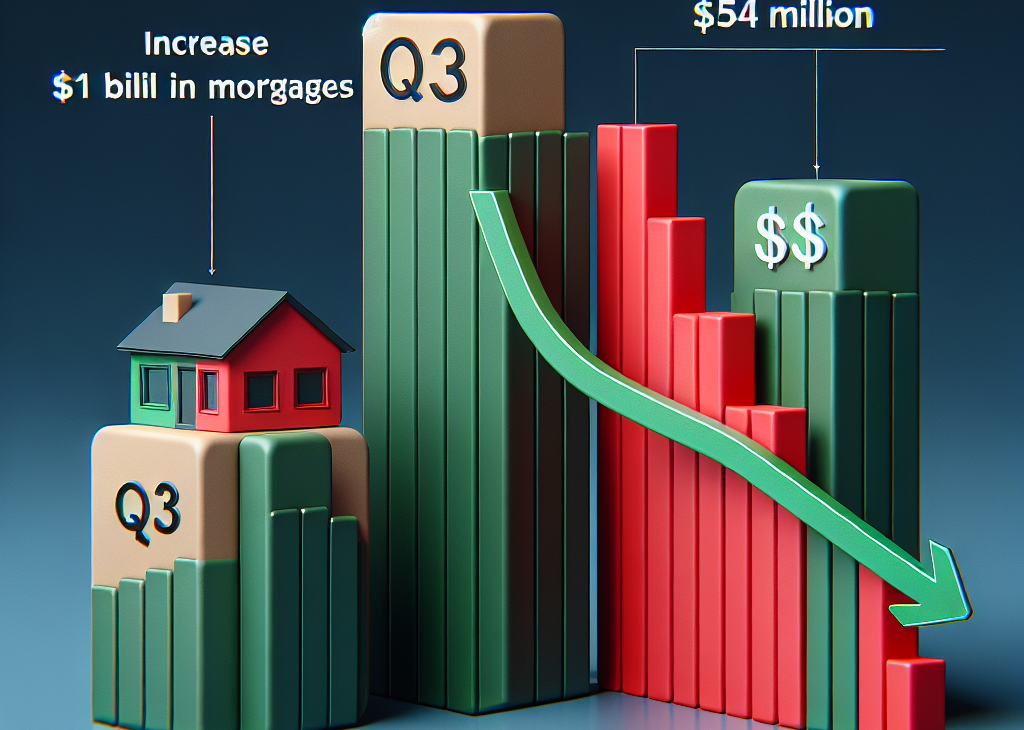

In the third quarter, Better, a digital mortgage lender, successfully funded $1 billion in mortgages, demonstrating resilience and operational capability despite facing a significant financial setback. The company reported a $54 million loss during the same period, highlighting the challenging economic environment and competitive pressures within the mortgage industry. This performance underscores Better’s commitment to maintaining its market presence and supporting homebuyers, even as it navigates financial hurdles. The company’s ability to fund a substantial volume of mortgages amidst losses reflects its strategic focus on leveraging technology to streamline the mortgage process and enhance customer experience.

Analysis Of Better’s $1B Funding In Q3 Mortgages Amidst Financial Losses

In the third quarter, Better, a digital mortgage lender, successfully funded $1 billion in mortgages, a notable achievement amidst a challenging financial landscape. This accomplishment, however, was juxtaposed with a reported $54 million loss, highlighting the complexities and inherent risks in the mortgage lending industry. The juxtaposition of these figures invites a deeper analysis of Better’s strategic maneuvers and the broader market conditions influencing its performance.

To begin with, the $1 billion in funded mortgages signifies a robust demand for Better’s services, reflecting its ability to attract and retain customers in a competitive market. This achievement can be attributed to Better’s innovative approach to mortgage lending, which leverages technology to streamline the application process, reduce costs, and enhance customer experience. By offering a digital-first platform, Better has positioned itself as a convenient and efficient alternative to traditional mortgage lenders, appealing particularly to tech-savvy consumers seeking a hassle-free borrowing experience.

However, the $54 million loss reported in the same quarter raises questions about the sustainability of Better’s business model. This financial setback can be partially attributed to the broader economic environment, characterized by rising interest rates and inflationary pressures. As central banks tighten monetary policy to combat inflation, borrowing costs have increased, dampening demand for new mortgages and refinancing. Consequently, mortgage lenders like Better face a more challenging operating environment, with reduced margins and heightened competition for a shrinking pool of potential borrowers.

Moreover, Better’s financial loss may also reflect its aggressive growth strategy, which prioritizes market share expansion over immediate profitability. In pursuit of long-term growth, the company has likely invested heavily in marketing, technology, and talent acquisition, all of which contribute to short-term financial strain. While this approach can yield significant rewards in the future, it necessitates a careful balancing act to ensure that operational costs do not outpace revenue growth.

In addition to these internal factors, Better’s performance must be viewed within the context of the broader mortgage industry, which is undergoing significant transformation. The shift towards digitalization, accelerated by the COVID-19 pandemic, has intensified competition among lenders, compelling them to innovate and adapt rapidly. Better’s digital platform is a response to this trend, positioning the company to capitalize on the growing preference for online mortgage solutions. However, this digital shift also lowers barriers to entry, enabling new players to enter the market and challenge established firms like Better.

Furthermore, regulatory changes and evolving consumer preferences are reshaping the mortgage landscape, necessitating agility and foresight from industry participants. Better’s ability to navigate these changes will be crucial in determining its future success. The company’s focus on customer-centric solutions and technological innovation provides a solid foundation, but it must also remain vigilant to emerging risks and opportunities.

In conclusion, Better’s $1 billion in funded mortgages during the third quarter is a testament to its market appeal and operational capabilities. Yet, the accompanying $54 million loss underscores the challenges inherent in the mortgage lending industry, particularly in a volatile economic environment. As Better continues to pursue growth and innovation, it must carefully manage its financial health to ensure long-term viability. By balancing strategic investments with prudent financial management, Better can position itself to thrive in an increasingly competitive and dynamic market.

Understanding The Impact Of A $54M Loss On Better’s Mortgage Strategy

In the third quarter, Better, a prominent digital mortgage lender, managed to fund an impressive $1 billion in mortgages, even as it reported a significant $54 million loss. This development raises questions about the company’s strategic approach to navigating financial challenges while maintaining its position in the competitive mortgage industry. Understanding the implications of this loss on Better’s mortgage strategy requires a closer examination of the company’s operational dynamics and market positioning.

To begin with, the $54 million loss, while substantial, must be contextualized within the broader financial landscape of the mortgage industry. The sector has been grappling with fluctuating interest rates, regulatory changes, and evolving consumer preferences, all of which have contributed to a challenging operating environment. For Better, these external pressures have likely exacerbated internal financial strains, leading to the reported loss. However, the company’s ability to fund $1 billion in mortgages during the same period suggests a strategic resilience and a commitment to sustaining its market presence.

One possible explanation for Better’s continued mortgage funding success lies in its innovative use of technology. As a digital-first lender, Better has leveraged advanced algorithms and data analytics to streamline the mortgage application process, offering a more efficient and user-friendly experience for borrowers. This technological edge may have enabled the company to attract a steady stream of customers, even as it contends with financial setbacks. Moreover, by reducing operational costs through automation, Better could potentially offset some of the financial losses incurred.

Furthermore, Better’s strategic focus on customer experience and satisfaction may have played a crucial role in its ability to fund a significant volume of mortgages. By prioritizing transparency, speed, and convenience, the company has differentiated itself from traditional lenders, appealing to a tech-savvy demographic that values digital solutions. This customer-centric approach not only enhances brand loyalty but also drives repeat business and referrals, contributing to sustained mortgage funding levels.

In addition to its technological and customer-focused strategies, Better’s financial management practices warrant consideration. The company may have adopted a long-term perspective, viewing the $54 million loss as a temporary setback rather than a permanent impediment. By strategically investing in growth initiatives, such as expanding its product offerings or entering new markets, Better could be positioning itself for future profitability. This forward-thinking approach underscores the importance of balancing short-term financial performance with long-term strategic goals.

Nevertheless, the $54 million loss cannot be overlooked, as it highlights potential vulnerabilities in Better’s business model. The company must address these challenges to ensure its continued viability and competitiveness. This may involve reassessing its cost structures, optimizing operational efficiencies, or exploring strategic partnerships to bolster its financial position. Additionally, Better must remain vigilant in monitoring market trends and adapting its strategies accordingly to mitigate risks and capitalize on emerging opportunities.

In conclusion, while Better’s $54 million loss in the third quarter presents a significant challenge, the company’s ability to fund $1 billion in mortgages during the same period reflects a strategic resilience rooted in technological innovation, customer-centricity, and forward-looking financial management. By addressing its financial vulnerabilities and continuing to adapt to the evolving mortgage landscape, Better can navigate its current challenges and position itself for sustained success in the future.

How Better Secured $1B In Q3 Mortgages Despite Financial Challenges

In the third quarter of 2023, Better, a digital mortgage lender, managed to secure $1 billion in mortgage originations, a notable achievement given the financial challenges it faced, including a reported $54 million loss. This accomplishment underscores the company’s resilience and strategic maneuvering in a highly competitive and volatile market. Despite the financial setback, Better’s ability to originate such a substantial volume of mortgages can be attributed to several key factors that have enabled it to navigate the complexities of the current economic landscape.

Firstly, Better’s technological infrastructure has played a pivotal role in its ability to process and approve mortgage applications efficiently. By leveraging advanced algorithms and automation, the company has streamlined the mortgage application process, reducing the time and effort required for both borrowers and lenders. This technological edge has allowed Better to offer competitive rates and faster service, attracting a significant number of customers even as traditional lenders face operational bottlenecks.

Moreover, Better’s focus on customer experience has been instrumental in maintaining its market position. The company has invested heavily in user-friendly digital platforms that simplify the mortgage process for consumers. By providing clear, transparent information and personalized support, Better has built a reputation for reliability and trustworthiness, which is crucial in an industry where customer confidence is paramount. This customer-centric approach has not only helped retain existing clients but also attracted new ones, contributing to the $1 billion in mortgage originations.

In addition to its technological and customer service strengths, Better has also strategically expanded its product offerings to cater to a broader audience. By diversifying its mortgage products, the company has been able to meet the varying needs of different customer segments, from first-time homebuyers to seasoned investors. This diversification has enabled Better to tap into new markets and mitigate the risks associated with economic fluctuations, thereby sustaining its growth momentum despite the financial losses.

Furthermore, Better’s ability to secure significant funding from investors has provided the necessary capital to support its operations and growth initiatives. The confidence shown by investors, even in the face of financial losses, indicates a strong belief in Better’s long-term potential and strategic direction. This financial backing has allowed the company to continue investing in technology, marketing, and talent acquisition, all of which are critical components of its growth strategy.

While the $54 million loss in the third quarter is a concern, it is important to consider the broader context in which Better operates. The mortgage industry has been grappling with rising interest rates, regulatory changes, and economic uncertainty, all of which have posed significant challenges for lenders. In this environment, Better’s ability to secure $1 billion in mortgages is a testament to its robust business model and strategic foresight.

In conclusion, Better’s success in originating $1 billion in mortgages during the third quarter of 2023, despite a $54 million loss, highlights the company’s resilience and adaptability. Through its technological innovations, customer-centric approach, diversified product offerings, and strong investor support, Better has demonstrated its capacity to overcome financial challenges and maintain its competitive edge in the mortgage industry. As the company continues to navigate the complexities of the market, its strategic initiatives will likely play a crucial role in shaping its future trajectory.

The Future Of Better’s Mortgage Business After A $54M Loss

In the third quarter of 2023, Better, a prominent digital mortgage lender, managed to fund an impressive $1 billion in mortgages, even as it reported a significant loss of $54 million. This development raises questions about the future trajectory of Better’s mortgage business, especially in a market characterized by fluctuating interest rates and evolving consumer preferences. Despite the financial setback, the company’s ability to secure substantial mortgage funding underscores its resilience and potential for growth in a competitive industry.

To understand the implications of Better’s recent financial performance, it is essential to consider the broader context of the mortgage market. The industry has been navigating a challenging landscape, marked by economic uncertainties and regulatory changes. In this environment, Better’s capacity to fund $1 billion in mortgages is a testament to its robust operational framework and strategic initiatives aimed at capturing market share. This achievement highlights the company’s commitment to leveraging technology to streamline the mortgage process, thereby enhancing customer experience and operational efficiency.

However, the $54 million loss cannot be overlooked, as it reflects underlying challenges that Better must address to ensure long-term sustainability. One contributing factor to this financial shortfall could be the increased costs associated with scaling operations and investing in technological advancements. As Better continues to expand its market presence, it is likely incurring significant expenses related to marketing, customer acquisition, and infrastructure development. These investments, while essential for future growth, may have temporarily impacted the company’s bottom line.

Moreover, the competitive nature of the mortgage industry necessitates continuous innovation and adaptation. Better’s digital-first approach positions it well to capitalize on the growing demand for online mortgage solutions. However, maintaining a competitive edge requires ongoing enhancements to its platform, which may involve substantial research and development expenditures. Balancing these costs with revenue generation is crucial for Better to achieve profitability in the coming quarters.

In light of these challenges, Better’s management team is likely exploring strategies to optimize operational efficiency and reduce costs. This may involve refining its customer acquisition strategies, enhancing its technological infrastructure, and exploring partnerships or collaborations that can drive synergies and cost savings. Additionally, Better may focus on diversifying its product offerings to cater to a broader range of customer needs, thereby increasing its revenue streams and mitigating risks associated with market volatility.

Furthermore, Better’s ability to navigate regulatory complexities will play a pivotal role in shaping its future success. The mortgage industry is subject to stringent regulations, and compliance is paramount to avoid legal and financial repercussions. By prioritizing regulatory adherence and risk management, Better can safeguard its operations and build trust with stakeholders, including customers, investors, and regulators.

In conclusion, while Better’s $54 million loss in the third quarter of 2023 presents challenges, the company’s ability to fund $1 billion in mortgages demonstrates its potential for growth and resilience in a dynamic market. By focusing on operational efficiency, technological innovation, and regulatory compliance, Better can position itself for long-term success. As the mortgage industry continues to evolve, Better’s strategic initiatives and commitment to customer-centric solutions will be instrumental in shaping its future trajectory and ensuring its continued relevance in the digital mortgage landscape.

Lessons From Better’s Q3 Performance: Balancing Growth And Losses

In the third quarter of 2023, Better, a digital mortgage lender, made headlines by funding $1 billion in mortgages, a significant achievement that underscores the company’s robust operational capabilities and market presence. However, this milestone was juxtaposed with a reported loss of $54 million, highlighting the complex dynamics of balancing growth with financial sustainability. This dual narrative of expansion and financial strain offers valuable lessons for businesses navigating similar challenges in the competitive financial services sector.

To begin with, Better’s ability to fund $1 billion in mortgages during a single quarter is a testament to its effective use of technology and customer-centric approach. By leveraging digital platforms, Better has streamlined the mortgage application process, making it more accessible and efficient for consumers. This technological edge not only enhances customer satisfaction but also positions the company as a formidable player in the mortgage industry. The significant volume of funded mortgages indicates strong demand for Better’s services, suggesting that the company has successfully tapped into a market need for more agile and user-friendly mortgage solutions.

However, the $54 million loss reported in the same quarter cannot be overlooked. This financial setback raises important questions about the sustainability of Better’s growth strategy. While rapid expansion can drive market share and brand recognition, it often comes with increased operational costs and investment in infrastructure, technology, and human resources. For Better, the challenge lies in managing these costs while continuing to innovate and expand its market reach. This scenario is not uncommon in the tech-driven financial services industry, where companies frequently prioritize growth over immediate profitability to establish a competitive edge.

Moreover, Better’s financial performance in Q3 highlights the importance of strategic financial management. Companies in high-growth phases must carefully balance investment in growth initiatives with prudent cost management. This involves not only optimizing operational efficiencies but also making strategic decisions about where to allocate resources for maximum impact. For Better, this could mean focusing on enhancing its technological capabilities, expanding its product offerings, or entering new markets to drive future revenue growth.

Additionally, the juxtaposition of growth and losses in Better’s Q3 performance underscores the need for effective risk management. As companies expand, they must navigate a complex landscape of market risks, regulatory challenges, and competitive pressures. For Better, mitigating these risks involves maintaining a strong compliance framework, staying attuned to market trends, and continuously adapting its business model to changing consumer preferences and economic conditions.

In conclusion, Better’s Q3 performance offers a compelling case study in balancing growth with financial sustainability. While the company’s ability to fund $1 billion in mortgages demonstrates its market potential and operational strengths, the accompanying $54 million loss highlights the financial challenges inherent in rapid expansion. For businesses in the financial services sector, the key takeaway is the importance of strategic financial management, effective risk mitigation, and a relentless focus on innovation. By learning from Better’s experience, companies can better navigate the complexities of growth and position themselves for long-term success in an increasingly competitive market.

The Role Of Strategic Planning In Better’s $1B Mortgage Funding

In the third quarter, Better, a prominent digital mortgage lender, successfully funded $1 billion in mortgages, a significant achievement that underscores the company’s strategic planning capabilities. Despite reporting a $54 million loss during the same period, Better’s ability to secure such a substantial amount in mortgage funding highlights the critical role of strategic planning in navigating financial challenges and capitalizing on market opportunities. This accomplishment is particularly noteworthy given the current economic climate, characterized by fluctuating interest rates and a competitive housing market.

Strategic planning has been at the core of Better’s operations, enabling the company to adapt to changing market conditions and maintain its competitive edge. By leveraging advanced technology and data analytics, Better has streamlined its mortgage application process, offering a seamless and efficient experience for its customers. This technological advantage not only enhances customer satisfaction but also allows Better to process a higher volume of applications, thereby increasing its funding capabilities. Moreover, the company’s focus on digital solutions positions it well to attract tech-savvy consumers who prioritize convenience and speed in their financial transactions.

In addition to technological innovation, Better’s strategic planning involves a keen understanding of market trends and consumer behavior. By closely monitoring these factors, the company can anticipate shifts in demand and adjust its offerings accordingly. For instance, Better has been proactive in expanding its product portfolio to include a variety of mortgage options, catering to diverse customer needs. This flexibility ensures that the company remains relevant and appealing to a broad customer base, even as market conditions evolve.

Furthermore, Better’s strategic planning extends to its financial management practices. Despite the reported loss, the company has demonstrated resilience by effectively managing its resources and investments. This includes optimizing operational efficiencies and cost structures to mitigate financial setbacks. By maintaining a strong focus on cost control and resource allocation, Better can sustain its growth trajectory and continue funding significant mortgage volumes.

Another critical aspect of Better’s strategic planning is its commitment to building strong partnerships and collaborations within the industry. By forging alliances with key stakeholders, such as real estate agents, financial institutions, and technology providers, Better enhances its market presence and expands its reach. These partnerships not only facilitate access to a wider customer base but also provide valuable insights and resources that support the company’s growth objectives.

Moreover, Better’s strategic planning is underscored by its emphasis on customer-centricity. By prioritizing customer needs and preferences, the company can tailor its services to deliver exceptional value. This customer-focused approach is evident in Better’s efforts to simplify the mortgage process, provide transparent pricing, and offer personalized support throughout the application journey. As a result, Better has cultivated a loyal customer base that contributes to its sustained funding success.

In conclusion, Better’s ability to fund $1 billion in mortgages during the third quarter, despite a $54 million loss, is a testament to the effectiveness of its strategic planning. Through technological innovation, market adaptability, financial prudence, industry partnerships, and customer-centricity, Better has positioned itself as a formidable player in the digital mortgage landscape. As the company continues to navigate the complexities of the financial market, its strategic planning will remain a vital component in achieving long-term success and growth.

Q&A

1. **What is Better Funds?**

Better Funds is a financial technology company that specializes in providing mortgage and home financing solutions.

2. **How much did Better Funds provide in mortgages in Q3?**

Better Funds provided $1 billion in mortgages during the third quarter.

3. **What was Better Funds’ financial loss in Q3?**

Better Funds reported a financial loss of $54 million in the third quarter.

4. **What is the significance of the $1 billion in mortgages?**

The $1 billion in mortgages indicates Better Funds’ continued activity and presence in the mortgage market despite financial losses.

5. **What challenges might Better Funds be facing?**

Better Funds might be facing challenges such as market competition, interest rate fluctuations, or operational inefficiencies contributing to their financial loss.

6. **What could be the potential impact of the $54 million loss?**

The $54 million loss could impact Better Funds’ financial stability, investor confidence, and future strategic decisions.Better, a digital mortgage lender, managed to fund $1 billion in mortgages during the third quarter despite incurring a $54 million loss. This performance highlights the company’s ability to maintain significant lending activity even in the face of financial challenges. The substantial volume of funded mortgages suggests that Better continues to have a strong market presence and demand for its services, although the financial loss indicates underlying operational or market difficulties that need to be addressed to ensure long-term sustainability and profitability.

Last modified: November 14, 2024